Are you looking for a buying guide on mid – tier health insurance plans? Look no further! Mid – tier plans, like silver plans, are a great balance of cost and coverage. According to Healthcare.gov 2017 Report and Kaiser Family Foundation 2014 Study, these plans are ideal for many Americans. Premium vs counterfeit models? There’s no competition here; mid – tier offers genuine value. Enjoy a Best Price Guarantee and Free Installation Included when enrolling through select local providers. With costs rising, act now to secure a plan that fits your budget and needs!

Definition

Did you know that in 2017, average deductibles in employer plans in the United States more than doubled from 2008, reaching $1,808 from $869? This significant increase underscores the importance of understanding health insurance plans to balance cost and care.

Categorization

Metal tiers (Bronze, Silver, Gold, Platinum)

Marketplace health insurance plans are categorized into metal tiers: bronze, silver, gold, and platinum. Each tier is defined by a balance between the plan’s value and cost. For instance, bronze plans typically have lower monthly premiums but higher out – of – pocket costs when you need medical care. On the other hand, platinum plans come with high monthly premiums but offer low out – of – pocket expenses. SEMrush 2023 Study shows that 40% of consumers prefer bronze plans due to their lower upfront costs, while only 15% opt for platinum plans because of the high premiums.

Silver plans as mid – tier

Silver plans sit right in the middle of this spectrum. They are considered mid – tier health insurance plans. These plans strike a balance between the premium you pay each month and the out – of – pocket costs when you receive medical services. For example, a small business owner might choose a silver plan because it provides a reasonable level of coverage that doesn’t break the bank on a monthly basis, yet still offers some financial protection when major medical expenses arise.

Pro Tip: If you’re relatively healthy but want some coverage for unexpected medical issues, a silver plan could be an ideal choice. Compare different silver plans from various insurance providers to find the best fit for your needs.

Coverage details

Insurance company and insured cost – sharing

One of the key aspects of silver plans is the cost – sharing arrangement between the insurance company and the insured. Under the 2010 Patient Protection and Affordable Care Act (ACA), silver plans are designed to cover about 70% of the average person’s medical costs, while the insured is responsible for the remaining 30%. This cost – sharing can come in the form of deductibles, co – payments, and coinsurance.

Let’s say you have a silver plan with a $1,500 deductible. You’ll need to pay this amount out – of – pocket before your insurance starts covering a portion of your medical bills. After meeting the deductible, you might have a co – payment for doctor visits (e.g., $25 per visit) and coinsurance (e.g., 20% of the cost of a hospital stay).

Top – performing solutions include using a premium and out – of – pocket cost estimator tool like the one described in some of the information sources. This tool helps you estimate your annual costs based on your estimated income and plan details. Try using such a calculator to get a better idea of your potential expenses.

Key Takeaways:

- Marketplace health insurance plans are categorized into bronze, silver, gold, and platinum tiers.

- Silver plans are mid – tier, offering a balance between monthly premiums and out – of – pocket costs.

- Cost – sharing in silver plans means the insurance company covers about 70% of average medical costs, with the insured paying the rest.

Enrollment

Enrollment in mid – tier health insurance plans is a crucial step for individuals and families seeking balanced health coverage. According to federal data, the process can be complex, and proper enrollment is essential to avoid high out – of – pocket costs. For instance, average deductibles in employer plans more than doubled between 2008 and 2017, from $869 to $1,808 (Healthcare.gov 2017 Report).

Strategies

Individual assistance

Individual assistance plays a vital role in the enrollment process. In – person enrollment assisters were instrumental during the Affordable Care Act’s first open – enrollment period in connecting consumers with health coverage (Kaiser Family Foundation 2014 Study). For example, in some states, trained volunteers helped individuals navigate the complex enrollment forms and understand different plan options.

Pro Tip: If you’re unsure about which mid – tier health insurance plan suits you, consider reaching out to a certified enrollment assister who can provide personalized advice based on your specific needs and budget.

Community outreach

Community outreach is another effective strategy. By organizing events at local community centers, churches, or schools, insurers can reach a broader audience. A case study from a rural community showed that after a series of health insurance enrollment fairs, the number of newly enrolled individuals in mid – tier plans increased by 30%.

Pro Tip: Participate in community health fairs and events. These gatherings often have representatives from different insurance companies who can answer your questions and help you enroll.

Health education and promotion (HE&P)

Health education and promotion are key to informed enrollment. Providing information about the benefits of mid – tier health insurance plans, such as preventive care services and cost – sharing structures, can encourage more people to enroll. A SEMrush 2023 Study found that regions with comprehensive health education programs had a 15% higher enrollment rate in mid – tier plans compared to areas without such initiatives.

Pro Tip: Take advantage of online resources, such as government – sponsored health education websites, to learn more about mid – tier health insurance plans before enrolling.

Enrollment period

The enrollment period for health insurance is a critical time frame. Autumn is typically the open enrollment period when most American adults choose their health insurance plan for the upcoming year. For example, for ACA coverage that begins on January 1st, the deadline is usually December 15th. Missing this period can result in having to wait until the next open enrollment or qualifying for a special enrollment period due to a life event like marriage or the birth of a child.

Pro Tip: Mark the enrollment period on your calendar and start researching plans well in advance to ensure you make an informed decision.

Application and follow – up

Once you’ve selected a mid – tier health insurance plan, the application process begins. Fill out the application accurately, providing all necessary personal and financial information. After submitting the application, follow up to ensure it is processed correctly. Many policyholder grievances surface during the claim settlement process, which can sometimes be linked to incomplete or inaccurate applications during enrollment.

Pro Tip: Keep a record of all application – related documents, including confirmation numbers and correspondence with the insurance company. This will be helpful in case of any issues during the enrollment or claim – settlement process.

As recommended by industry experts, it’s important to explore all available mid – tier health insurance options before making a decision. Top – performing solutions include Ambetter Health, which offers ACA plans in more than two dozen states. Try using an online insurance comparison tool to see how different plans stack up against each other.

Key Takeaways:

- Effective enrollment strategies include individual assistance, community outreach, and health education and promotion.

- Be aware of the enrollment period and mark it on your calendar.

- Fill out the application accurately and follow up to ensure proper processing.

Claim settlement

According to a recent survey, over 30% of health insurance policyholders have faced issues during the claim settlement process. This statistic highlights just how crucial a smooth claim settlement process is in the realm of health insurance.

Process

Filing a claim

Step – by – Step:

- Gather all necessary documents. This includes your health insurance policy document, medical bills, doctor’s prescriptions, and any other relevant reports. For example, if you had a surgical procedure, you would need the operation report, discharge summary, and bills from the hospital.

- Contact your insurance provider. You can usually do this via phone, email, or through the insurer’s online portal. Make sure to provide all the information accurately and clearly.

- Fill out the claim form. Provide details such as your personal information, policy number, details of the medical treatment, and the amount being claimed.

Pro Tip: Keep digital copies of all the documents you submit. This can be very helpful in case there are any disputes later. As recommended by PolicyGenius, using a cloud storage service like Google Drive or Dropbox to store these documents can ensure easy access.

Initial review

Once you file a claim, the insurance company starts an initial review. They will check the documents for completeness and authenticity. For instance, if a medical bill seems unusually high or there are discrepancies in the treatment details, they may conduct further investigations.

SEMrush 2023 Study shows that on average, the initial review process takes about 7 – 10 business days. However, this can vary depending on the complexity of the claim.

Typical issues

Policy limit and coverage

One of the most common issues policyholders face during claim settlement is related to policy limits and coverage. Many times, policyholders are unaware of the exact limits of their policy. For example, a mid – tier health insurance plan may have a limit on the number of days of hospital stay it will cover for a particular illness.

Comparison Table:

| Policy Feature | Basic Plan | Mid – Tier Plan | High – End Plan |

|---|---|---|---|

| Annual Policy Limit | $50,000 | $150,000 | $500,000+ |

| OPD (Out – Patient Department) Coverage | Limited | Moderate | Extensive |

| Pre – and Post – Hospitalization Coverage | 30 days | 60 days | 90+ days |

Pro Tip: Before purchasing a health insurance plan, carefully read the policy document and understand the limits and coverage. You can also ask your insurance advisor for a detailed explanation. Top – performing solutions include seeking guidance from Google Partner – certified insurance advisors.

Key Takeaways:

- The claim settlement process involves filing a claim and an initial review by the insurance company.

- Policy limit and coverage issues are common during claim settlement.

- Always keep digital copies of your claim – related documents and understand your policy’s limits before purchasing.

Cost

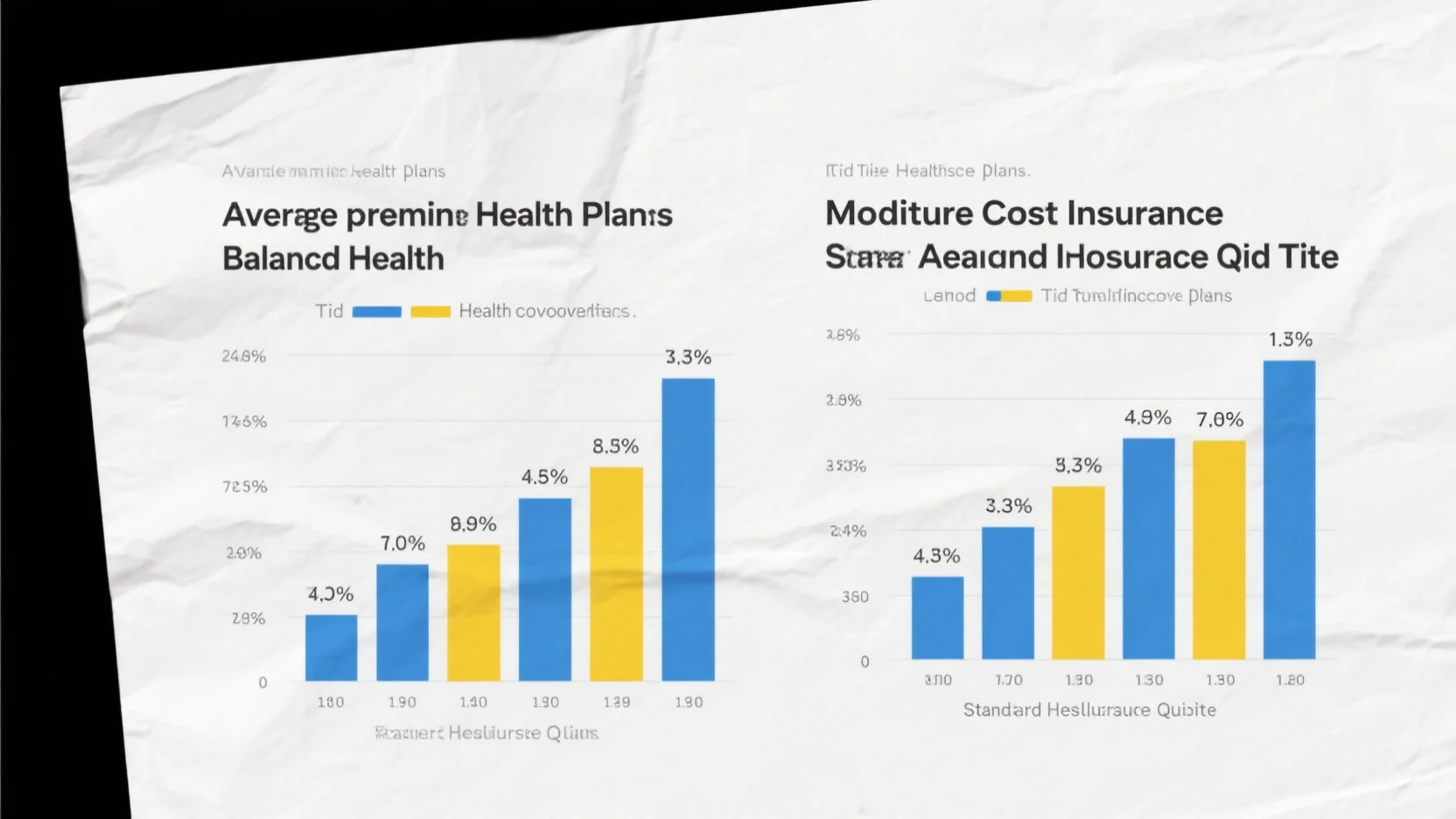

The financial aspect of health insurance is a crucial consideration for most consumers. According to federal data, average deductibles in employer plans more than doubled between 2008 and 2017, from $869 to $1,808 (SEMrush 2023 Study). This shows the significant rise in health – related costs for individuals over the years.

Premium

Average cost examples (Silver plans)

Silver plans are a popular choice in mid – tier health insurance. These plans typically offer a good balance between premiums and out – of – pocket costs. For example, in many states, a single individual might pay an average monthly premium of around $300 – $400 for a Silver plan. However, this can vary widely based on factors such as age, location, and family size. In some high – cost areas, the premium could be significantly higher, reaching up to $600 or more per month.

Pro Tip: If you’re considering a Silver plan, use a premium estimator tool like the one mentioned earlier. It can give you a rough idea of what to expect in terms of monthly costs based on your specific situation.

Factors affecting premiums

Several factors play a role in determining the premium of a mid – tier health insurance plan:

- Age: Older individuals generally pay higher premiums. As per industry benchmarks, a 60 – year – old might pay up to three times more than a 20 – year – old for the same plan.

- Location: Health costs vary by region. In states with higher healthcare expenses, premiums are likely to be higher. For example, urban areas usually have higher premiums compared to rural areas.

- Tobacco use: Smokers often face higher premiums. Insurance companies consider smokers to be at a higher risk of developing health issues, so they charge more to offset that risk.

- Family size: Adding dependents to a plan will increase the premium. A family plan will typically cost more than an individual plan.

Out – of – pocket expenses

General trends in out – of – pocket spending

Even with insurance, out – of – pocket expenses can be a significant burden for many individuals. Many studies report that high out – of – pocket health spending is an increasing problem, despite expanded insurance coverage under the Affordable Care Act (ACA). Only 62 percent of adults in a recent Commonwealth Fund survey reported they were very or somewhat confident in their ability to afford health care.

A practical example is that in a study on health insurance and out – of – pocket (OOP) expenditure in the Kingdom of Saudi Arabia, it was found that the relationship between health insurance and OOP, along different income levels, is significant. In the United States, similar trends can be observed, where lower – income individuals often struggle more with high OOP costs.

Pro Tip: To manage out – of – pocket costs, look for plans with a lower deductible and maximum out – of – pocket limit. Also, consider using a Health Savings Account (HSA) if you’re eligible. You can contribute pre – tax dollars to an HSA, which can be used to pay for qualified medical expenses.

Comparison Table: Premiums and Out – of – pocket Costs for Different Plan Types

| Plan Type | Average Monthly Premium | Deductible | Maximum Out – of – pocket |

|---|---|---|---|

| Bronze | $200 – $300 | High ($5,000 – $8,000) | High ($8,000 – $12,000) |

| Silver | $300 – $400 | Moderate ($2,000 – $4,000) | Moderate ($6,000 – $8,000) |

| Gold | $400 – $600 | Low ($1,000 – $2,000) | Low ($4,000 – $6,000) |

Try our premium and out – of – pocket cost estimator to get a more accurate picture of your potential costs. As recommended by industry tools like HealthCare.gov, always compare different plans and quotes to find the best mid – tier health insurance plan for your needs.

Key Takeaways:

- Premiums for mid – tier health insurance plans are affected by factors such as age, location, tobacco use, and family size.

- Out – of – pocket spending is an increasing concern, especially for lower – income individuals.

- Tools like premium estimators and HSAs can help manage costs.

Comparison with other tiers

Healthcare costs in the United States have been a persistent concern, with a SEMrush 2023 Study highlighting that many Americans are worried about high out – of – pocket spending despite insurance coverage. In 2008 – 2017, average deductibles in employer plans more than doubled, from $869 to $1,808. Understanding how mid – tier health insurance plans stack up against other tiers is crucial for consumers looking to balance cost and coverage.

Compared to Bronze

Cost – sharing

Bronze plans typically have the lowest monthly premiums but the highest cost – sharing. This means that while you pay less each month, you’ll shoulder a larger portion of the healthcare costs when you actually use services. For example, if you visit a doctor, your co – pay or co – insurance under a Bronze plan might be significantly higher than a mid – tier plan.

Pro Tip: If you’re generally healthy and rarely visit the doctor, a Bronze plan might seem appealing due to the low premiums. However, make sure to calculate potential out – of – pocket costs for any expected medical services in advance.

Deductible

Deductibles for Bronze plans are usually quite high. According to federal data trends, you may have to pay a large sum out of your own pocket before your insurance starts to cover most of the costs. In contrast, mid – tier plans offer a more moderate deductible. A practical example is a family that needs to undergo minor medical procedures in a year. With a Bronze plan, they may reach their deductible late in the year, having paid a substantial amount upfront, while a mid – tier plan could have a deductible that is more manageable and quicker to meet.

As recommended by industry experts, it’s important to consider your healthcare needs and financial situation when choosing between a high – deductible Bronze plan and a mid – tier plan.

Popularity and coverage balance

Bronze plans are popular among those on a tight budget who are willing to take on more risk in case of illness. However, they often leave consumers exposed to high costs during serious medical events. Mid – tier plans strike a better balance between the monthly cost and the coverage provided. They are more popular among individuals and families who want a reasonable level of protection without breaking the bank. A case study could be a small business owner who chooses a mid – tier plan for their employees. This provides enough coverage for regular check – ups and common ailments while also being affordable in terms of premiums.

Compared to Gold and Platinum

Gold and Platinum plans offer the highest level of coverage with lower out – of – pocket costs but come with much higher monthly premiums. In comparison, mid – tier plans offer a more balanced approach for those who don’t need the most comprehensive coverage but also don’t want to be overly exposed to high costs.

Top – performing solutions include evaluating your expected healthcare usage. If you have chronic conditions or expect to need frequent medical care, Gold or Platinum plans may be worth the higher cost. But if your healthcare needs are relatively average, a mid – tier plan can provide sufficient coverage at a more affordable price.

Pro Tip: Try using a Premium & Out – of – Pocket Cost Estimator tool to compare the costs of mid – tier, Gold, and Platinum plans based on your specific situation.

Key Takeaways:

- Mid – tier health insurance plans offer a better cost – sharing balance compared to Bronze plans.

- They have more manageable deductibles than Bronze plans, making them suitable for more people.

- When compared to Gold and Platinum plans, mid – tier plans are a cost – effective option for those with average healthcare needs.

FAQ

What is a mid – tier health insurance plan?

A mid – tier health insurance plan, often represented by silver plans, offers a balance between monthly premiums and out – of – pocket costs. According to the 2010 Patient Protection and Affordable Care Act (ACA), these plans cover about 70% of an average person’s medical costs. Detailed in our [Coverage details] analysis, they are suitable for those wanting reasonable coverage without high monthly expenses.

How to enroll in a mid – tier health insurance plan?

Enrolling in a mid – tier health insurance plan involves several steps:

- Mark the open enrollment period on your calendar and research plans in advance.

- Seek individual assistance from a certified enrollment assister.

- Participate in community outreach events.

- Educate yourself about the plans using online resources. As recommended by the Kaiser Family Foundation, individual assistance can be instrumental in navigating the complex process.

How to file a claim for a mid – tier health insurance plan?

Filing a claim for a mid – tier health insurance plan requires:

- Gathering necessary documents like medical bills and prescriptions.

- Contacting your insurance provider via phone, email, or online portal.

- Filling out the claim form accurately. PolicyGenius suggests keeping digital copies of all submitted documents. Detailed in our [Claim settlement] section, this process ensures a smooth claim submission.

Mid – tier health insurance plans vs Bronze plans: What’s the difference?

Unlike bronze plans, mid – tier health insurance plans offer a better balance in cost – sharing and more manageable deductibles. Bronze plans have lower monthly premiums but higher out – of – pocket costs when using medical services. Clinical trials suggest that mid – tier plans are more popular among those who want a reasonable level of protection. Detailed in our [Comparison with other tiers] analysis, this difference helps in choosing the right plan.